Going Beyond the Buzz – First Speaks – Medium

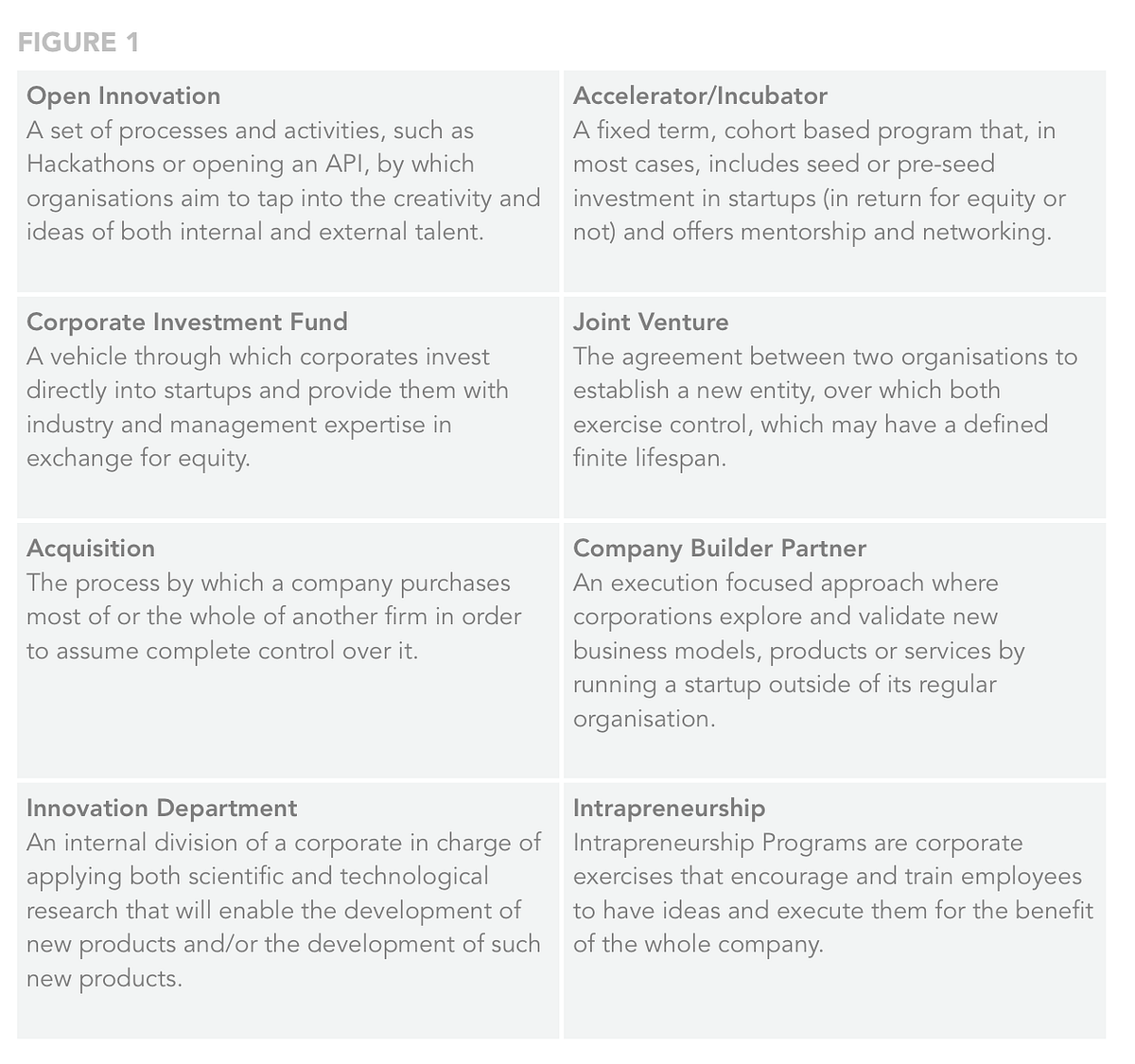

Solutions are flourishing all over the world to the challenge of staying up to date with the pace of innovation. In First's last post, my partner Pol Hortal outlined the eight basic innovation models that we identified corporates are leveraging today in order to deal with the realities explained in our previous posts Becoming Goliaths (how size delivers great advantages but trumps speed), Context Acceleration (data indicating the accelerated nature of today's competitive context) and the Dilemma that large established organisations face given these facts. Figure 1 gives a summary description of each of them.

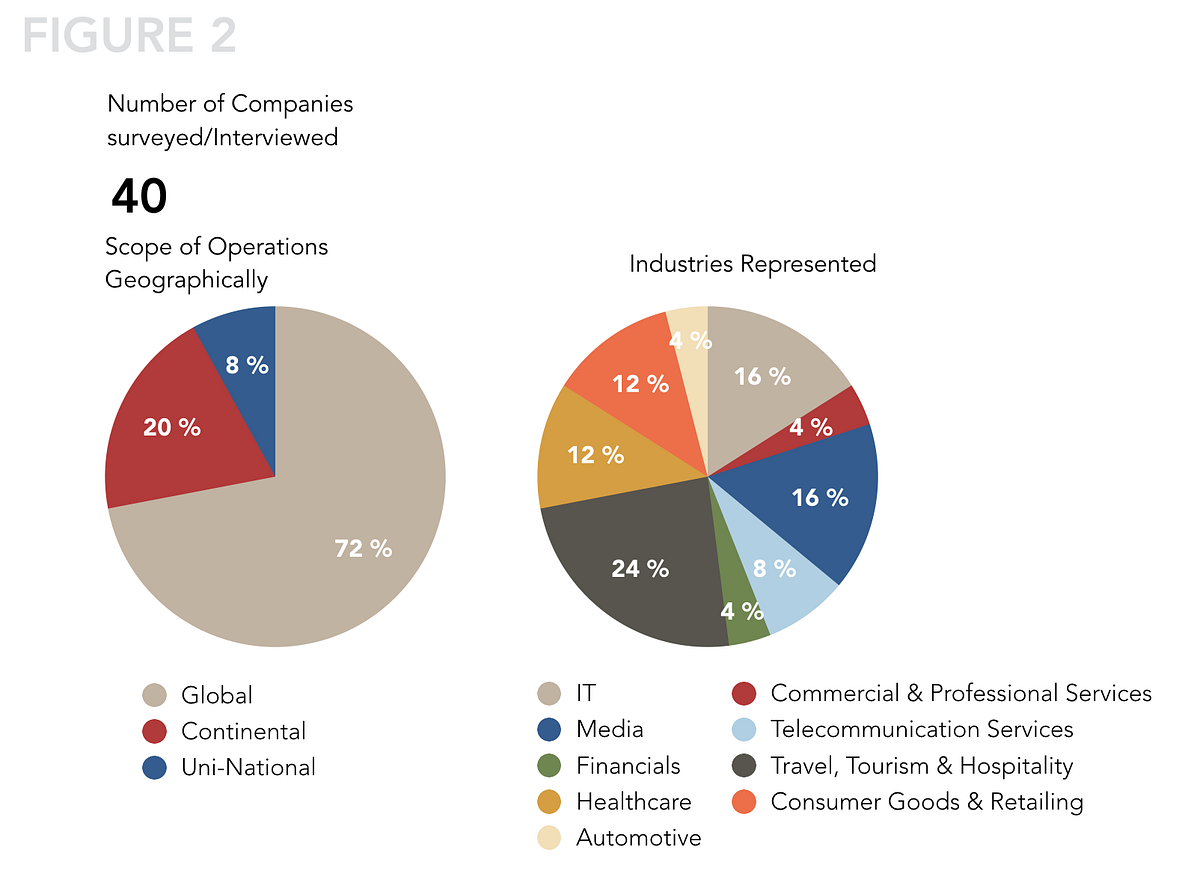

What we realised was that most of the time these different operations, all aimed at solving very similar overall challenges, were not compared with each other. There is a significant cacophony of experts, consultants and innovation managers praising the virtues of the models they pursue (or try to sell). We wanted to go beyond the buzz and try to better understand how each of these models work. So instead of focusing on the massive amount of theory around them (and there is a lot of good reports out there) we thought that the best would be to empirically compare them by interviewing executives at companies that executed them. We asked them to give us data points on six variables: Areas of Impact, Investment Made, Time to Early ROI, Number of Employees Involved, Control over the Ventures and Momentum. After a lot of introductions and meetings we achieved to gather data from 40 companies; the details of our sample are explained in Figure 2.

It is important to mention that with 40 companies and, in some data points, a certain subjectivity of the respondent, the data gathered is obviously not final; but it does point in a certain direction and opens up a series of consecutive questions. This piece presents the key findings and opens up the questions that we would like to answer next.

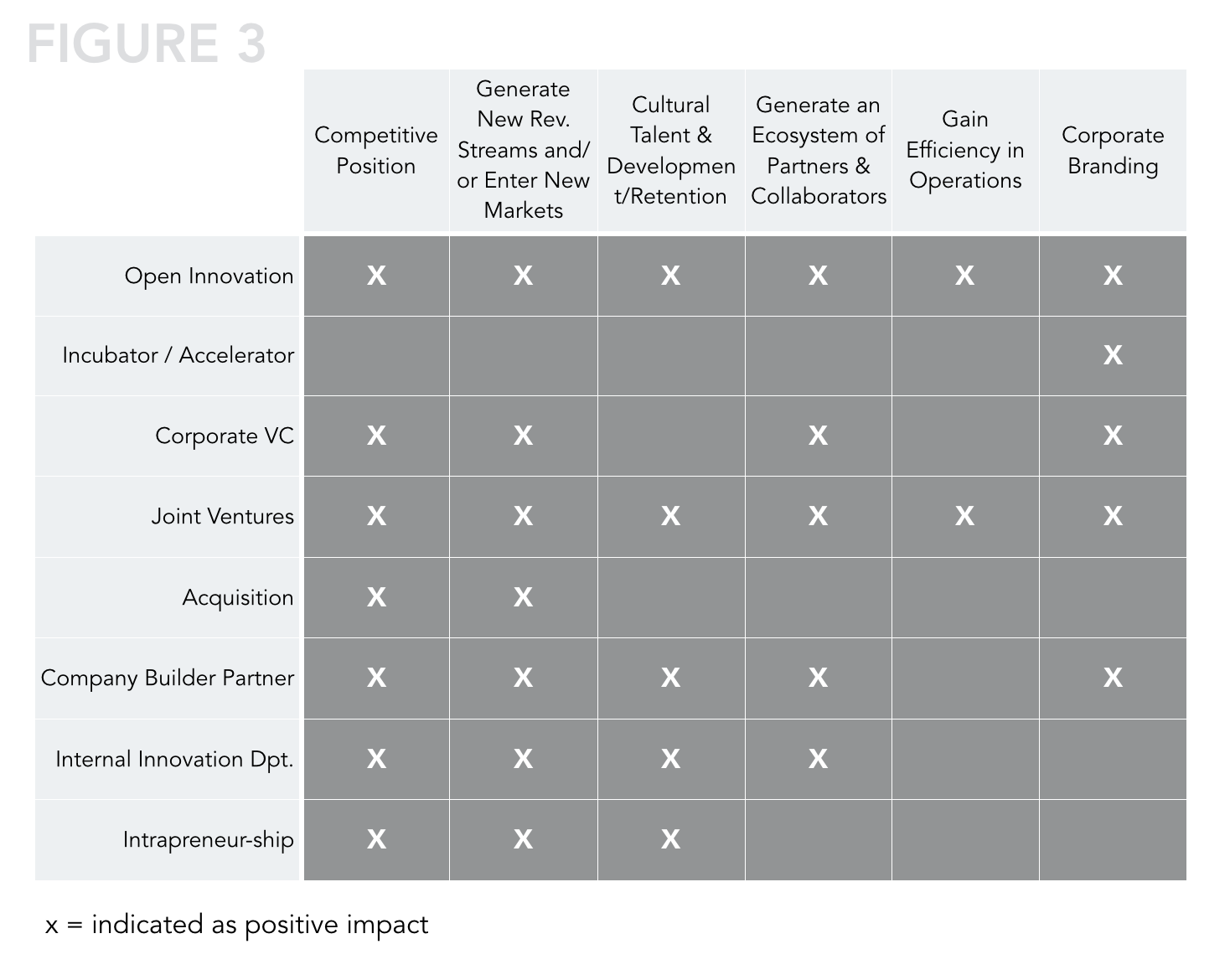

Regarding the first variable under study, the strategic question of which areas each model impacts. Figure 3 marks with an ''X'' those areas for which the Mode of the contestants has been positive. It is important to note that this does quantify the impact, it is simply ''Neutral'' or ''Positive'' and thus a model with multiple ''Xs'' does not necessarily mean that it is better than the others. The decision to present the data in this form is because we do not have enough data points to statistically feel comfortable quantifying the result on a scale.

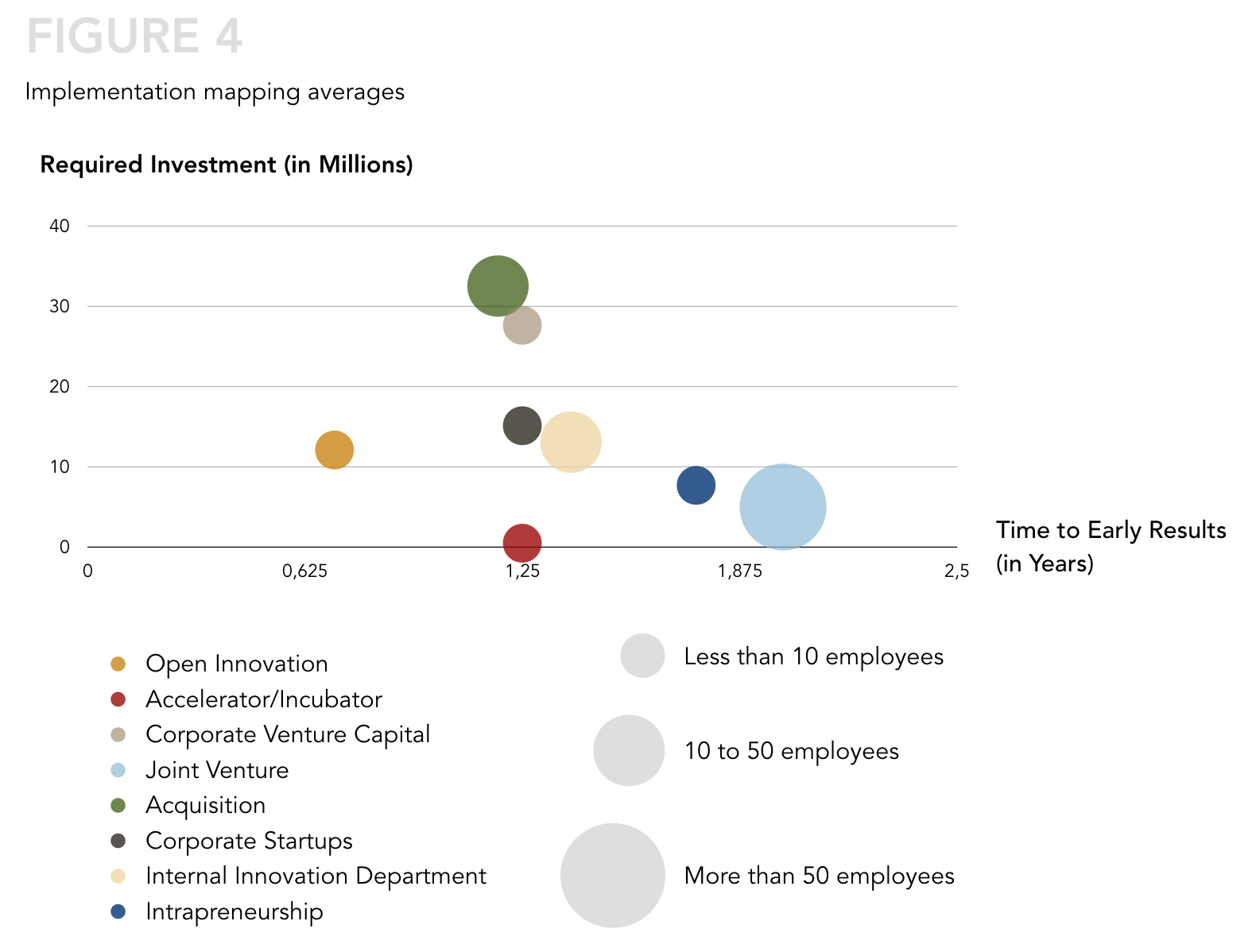

Secondly three fundamental implementation variables to take into consideration: Investment, time to ROI and team size. These are mapped in Figure 4. A note of caution here is the difference between modes and averages. The Graph here included maps the averages but, in some cases (for example Open Innovation) the Mode is very different from the Average. For more detailed data please request our full report (including modes and a paper for each model with all data points) under the following Link.

The last two variables compared in our research so far are Momentum and Control and are mapped (not quantitatively) in Figure 5. Here, Momentum will be directly correlated with the number of validated hypotheses a venture has (usually high Momentum will mean validated enough to be having revenues or, at least, a viable business model at scale). In other words, Momentum is the certainty that a venture will be capable of delivering all expected results from a purely business perspective. Control, on the other hand, is the power of the corporate over the ventures or projects being carried under each model. Again, in other words, Control will usually equate to the percentage equity and control of the Board to take decisions.

To close with, the mapped data is not definite but does point in a certain direction and should help to go beyond the buzz of multiple initiatives and look at innovation efforts with an informed strategic perspective. The key fundamental conclusion is that with innovation models there is no ''one size fits all'', and corporates and service providers will need to move beyond buzzes and trends to get it right. It is as simple as, just as with any other process in an organisation, the realities and overall strategic objectives need to be taken into consideration before investing in one or another operation. We hope to be contributing to this approach.

This said, there are some data points that are at least surprising, and when we look at our research we often find ourselves with even more questions than we had at the beginning. That is why I would like to finish with three notes:

Firstly, me and my team would love to invite you to request our full report in .pdf under this Link

Secondly, as the research leader, I am currently writing a piece with some of the key questions that have emerged from the research. If you have any comments, observations or further questions please do not hesitate to get in touch albert@firstprograms.co

Last but not least, if you work for a corporate and would like to (in absolute confidentiality) add data points to the research, we will be more than happy to count with you. Again, contact me personally in that case albert@firstprograms.co

Cover Photo by Paul Albertella

Enviado desde mi iPad

Comentarios